That has reached maximum potential.

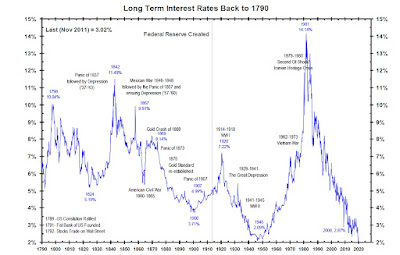

The ability to engineer rates lower and lower like what has been going on for the past 37 years is basically over."-- Me June 22, 2019

Now the authorities are promoting yield rate increases to combat inflation.

Ok look.

Yield rates are a demand for growth.

If your money supply is growing by 5% and that is too much inflation then how are you going to fight inflation by increasing the demand for growth by another 1% to 6%

Really this is what the authorities are claiming.

If the current yield rate in Canada is 0.25% and it was raised up to 0.50% that would mean that to combat inflation you are effectively doubling the growth rate.

Inflation is a problem lets double the growth rate to solve the problem.

33 is a magic number supposedly.

I looked up the date 33AD due to it being the agreed upon crucifixion date.

But also found this.

Credit.

Like the current system in operation.

How did that work back then?

The same way it does now because mathematics did not change.

$100,000 amortized at 6.636 for 25 years works out like the below.

The monthly payment is $666.67

The $666.67 breaks down into a principal payment of $136.42 and Interest of $530.25

You go to a bank and ask for a loan of $100,000

They add $100,000 to your account like out of thin air.

That is what credit is.

But you owe the bank $100,000 that is the asset.

Because they lent this $100,000 to you which is a liability that they created from nothing other than the collateral backing it up which is you.

You sign on the dotted line agreeing to pay back the loan over the next 25 years.

There is the principal amount which is $100,000.

After the first payment the $100,000 drops down to $100,000 - $136.42 = 99,836.58

The $100,000 created out of thin air returns back into thin air as the payments are made.

In 25 years the principal amount of $100,000 created out of thin air will return back into thin air when the last payment is made and the principal amount shrinks to $0.

What about the Interest of 530.25?

The bank gets that because what has happened is the bank has borrowed $100,000 from 25 years in the future to spend in the past or present.

Because that is what the interest payment does.

It eventually over the space of 25 years adds up to the original $100,000.

That is the profit that the bank obtains from this.

They do not have the $100,000 that they lend out but they will in 25 years after you spend the next 25 years supplying it to them.

This 6.636% over 25 years is the zero point where there is no inflation.

$100,000 is created and at the end of it all in 25 years all that is left is $100,000

What if the mortgage rate is lower?

Like 2%

$100,000 after 25 years at 2% yields a profit of $27,156.77

-72,843.23

Below 6.363% it is short term inflationary but long term deflationary.

How about if the demand for growth rate was 9%

$100,000 after 25 years at 9% yields a profit of $151,755.93

+51,755.93

Above 6.363% it is short term inflationary and long term inflationary.

Yield rates were last around 6.363% around the year 2000.

Remember what happens back then?

Y2K that collapsed down into 911..

Since then the inflation of the circulating money supply which is comprised of credit has been long term deflationary.

That is why there is so much credit creation currently.

You need massive credit creation to sustain inflation.

Look at all the debt inflation during the covid19 crisis that just happened to show up right where long term growth rates reached the maximum potential to drop lower.

Since so many of you all are net consumers of resources you all require massive amounts of credit inflation to supply your demand.

Prices are rising so fast because the demand by you all from you all has become greater than the supply by you all to you all.

You can see the last time around where yields slowly but surely were engineered lower and lower down to WW2 or the liquidation climax of the 1933 to 1945 bankruptcy reorganization of the global system and then following that yields rose up to 1981 and then were engineered lower and lower again down to where we are now.

In the above the yield rates are lower than they have ever been in the history shown in the above chart.

We are basically at the same point currently as we were following WW2.

You all will demand more and more and yields/prices will rise higher and higher to supply your demand for more and more and all of you will speculate as to who or what is behind all of this and none of you will find the culprit which is you all.